You must know what taxes are in order to comprehend how they work.

There are several reasons why taxes are required, but the most important is that they help the government raise money and help boost economic growth. Tax payments ensure that everyone around the country have access to basic amenities and services. To collect taxes on behalf of the people, the government is mandated under the constitution to do so. The three-tiered tax structure in India includes the national government, state governments, and local municipalities.

There are a plethora of different taxes and fees.

Both a direct tax and an indirect tax exist in most nations.

A direct tax is one that is levied on a single individual and then remitted to the government agency that levied it. This tax is administered by the Central Board of Direct Taxes (CBDT).

Important Direct Taxes are as follows:

- Taxes are an unavoidable burden that must be endured.

- Rich people’s income tax

- Gifts are subject to a gift tax.

- Tax on estates and gifts

- Sales of securities generate income.

- Inheritance and profit-sharing taxes

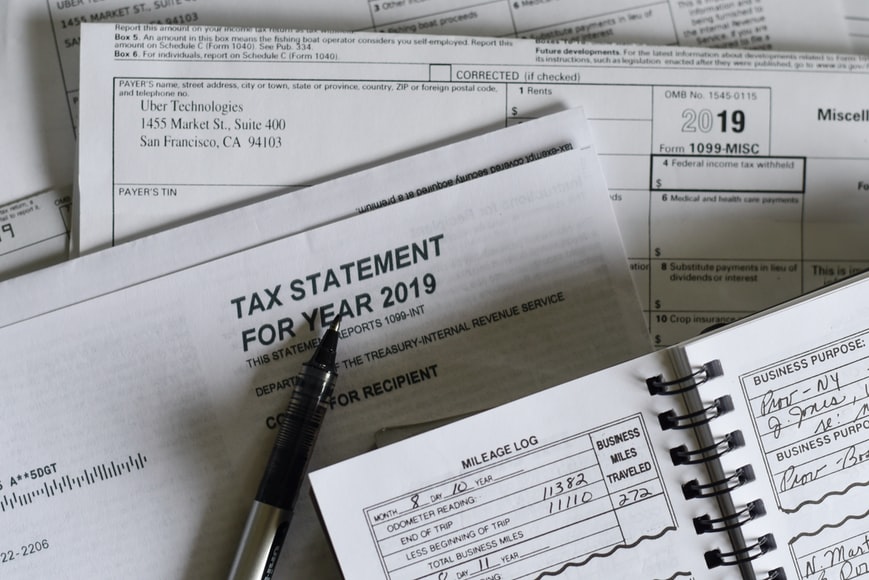

Income tax is the most common type of taxes on individuals. An individual’s yearly income is subject to this tax. Depending on where the taxpayer lives, the tax rate is calculated. Corporate entities such as partnerships, co-ops, and trusts are all included in this category, as is the Hindu Unified Family (HUF).

Indirect taxes are levied on the general population in this manner. It’s common practise to charge for most of these in the form of products or services. As a result, these taxes are included in the selling price and are then collected by the respective government agencies.

The following are examples of indirect taxes worth mentioning:

- Goods and services tax

- It’s referred to as Value Added Tax (VAT)

- Imports are taxed.

- Toll charges

- Octroy’s duty

- Tax collection is the responsibility of whom?

- The Ministry of Finance is one of three statutory bodies tasked with tax collection.

- Different taxes, such as federal income taxes, customs fees, and excise tax are collected by the central government.

- Agriculture, professional tax, excise duty, value-added tax, etc. are all taxes that are collected by the federal government.

- In addition to water and property taxes, local governments collect taxes.

- Federal government, on the other hand, instituted the Good and Services Tax (GST) in 2017 to unify a variety of taxes into a single one. Among the taxes that the GST would replace are the following:

- Products and services are taxed.

- Octroi

- Tax imposed by the United States government.

- The entertainment usage tax

- Purchase-related taxes

GST is a location-based tax at every stage of the supply chain (from raw material procurement to finished product sale to the end consumer). GST is often levied if there is a transfer of ownership or a change in the value of the supply.

GST must be collected from consumers at their final resting place, which is controlled by their country’s government (GST). GST is made up of the following three parts:

The CGST is a federal tax on goods and services delivered within a single state that is collected by the federal government.

State Goods and Services Taxes are levied by the state government or Union Territory on goods and services delivered inside the state (SGST).

For example, in Igst, where the central authority collects taxes on goods and services sold outside of the state.

Who stands to benefit from taxes?

Even though many people despise paying taxes, it is necessary for them to do so. Taxes are collected to aid in the development of the country and to provide its people with resources. There are a number of fundamental deductions, exemptions, and deductions for tax-saving investments offered by the government to assist lessen the burden of taxes.

An ITR may help you get a loan, improve your credit rating, and speed up the visa application process. In order to claim a tax refund, ITR papers may be used as proof of self-employment income.