You must know what taxes are in order to comprehend how they work. There are several reasons why taxes are

In order to understand the many types of taxes, it is important to know what they are. Taxes are a necessary aspect of the government's revenue collection and a vital part of fostering the nation's

Understanding taxes requires a basic understanding of what they are. In addition to helping the government generate funds and spurring

What is the meaning of the sales tax? Sales Tax is the name given to the tax levied on the

What is the service tax? Tax on services? The Central Government of India imposed a levy on service providers in

The tax paid by corporations GmbHs, cooperatives, foundations, etc. are subject to income tax. Domestic legal entities like as companies, cooperatives, and organisations are subject to the corporate income tax (KSt). It is analogous to

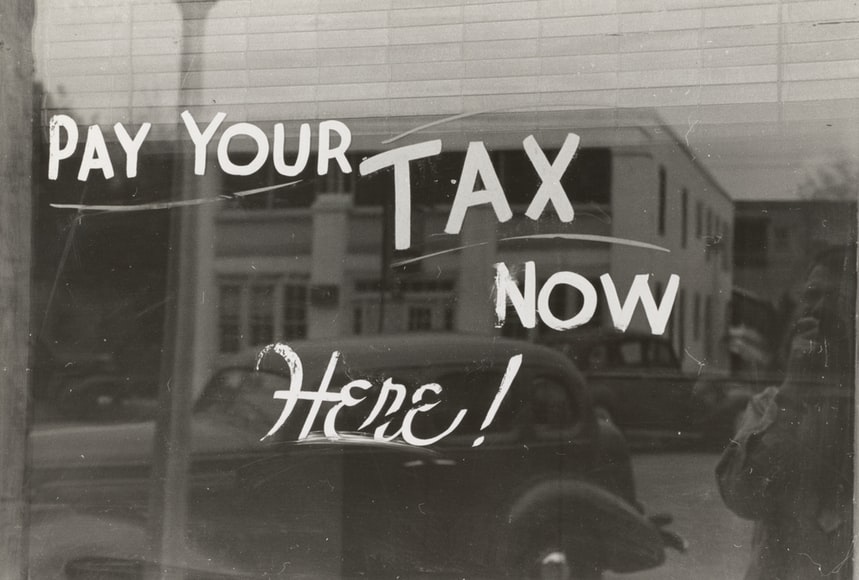

Gambling, alcohol, and air travel are all charged in this image. Taxes / Excise Tax / What is excise tax?

Tax Perquisites: What Are They? Perquisites or fringe benefits are tied to every income earner in the same way that

Defintion of value-added tax GST (Products and Services Tax) is an excise tax levied on the majority of goods and